1099 Withholding with Catch.Co

Disclaimer: Misclassification of your employees as independent contractors is illegal. The IRS sets clear guidelines for who can be an independent contractor and who cannot, see here (https://www.irs.gov/newsroom/understanding-employee-vs-contractor-designation) Furthermore most people who work in the film industry are employees as they are told when to report to work, when to go home, when to go to lunch, and has no opportunity for profit or loss. If you want to report your employer for misclassification, fill out IRS Form SS-8 (https://www.irs.gov/pub/irs-pdf/fss8.pdf) That being said, equipment rental is paid out with a W-9. Please keep this in mind for this review.

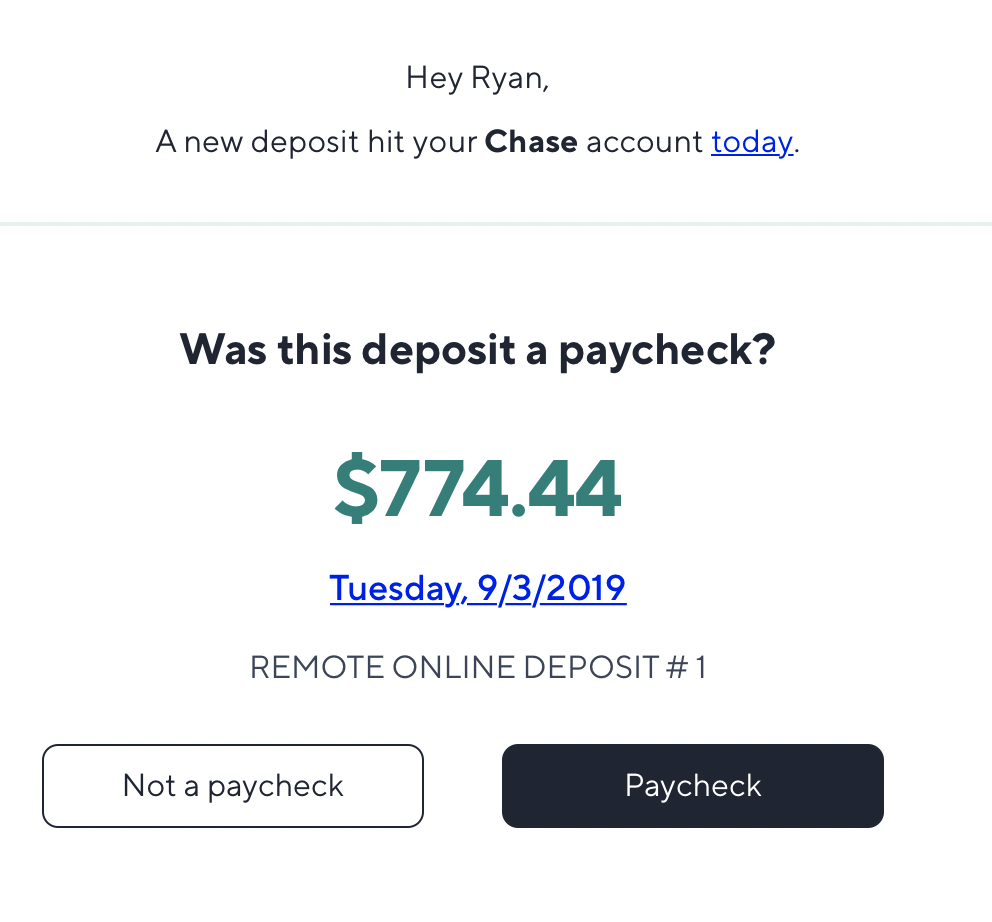

I have no problem admitting I found Catch.Co through a targeted facebook ad. They really knew me! It claimed to lessen the headache for those who are working as both an independent contractor and as an employee and I knew I had to try it out. Basically how it works is you hook it up to your bank account and then it monitors that account for any deposits. When a deposit hits, you get an email or a push notification from their app asking you about this deposit.

In this instance, it was for a kit fee that I needed taxes withheld on. I haven’t been buying tons of new gear recently, so withholding taxes has become even more important for me.

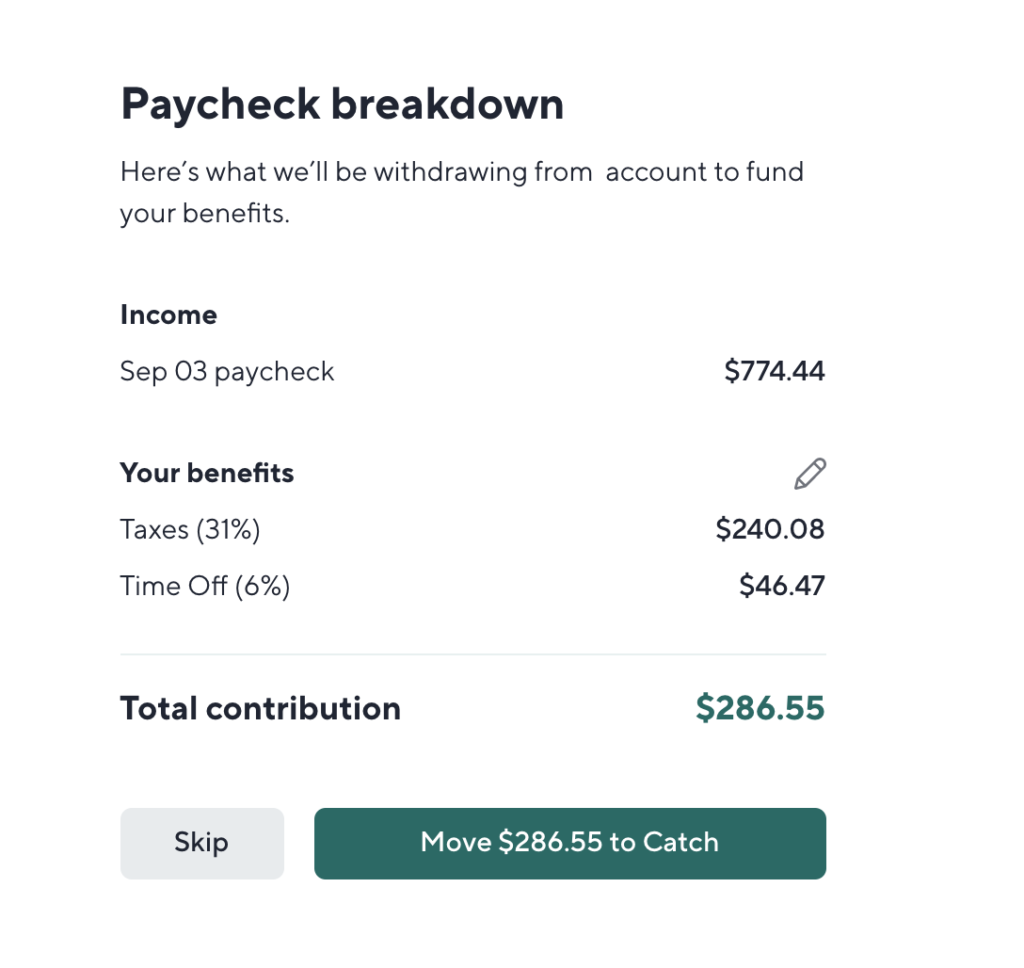

When I setup my plan with catch.co, I went through a few simple steps and figured out how much I wanted to withhold for different things. You can choose from a number of different options, setting aside money for taxes, vacation time, retirement, health insurance, dental insurance, life insurance….it’s a long list of possibilities. Because I have a number of these things covered already, I chose just to withhold money for taxes and vacation.

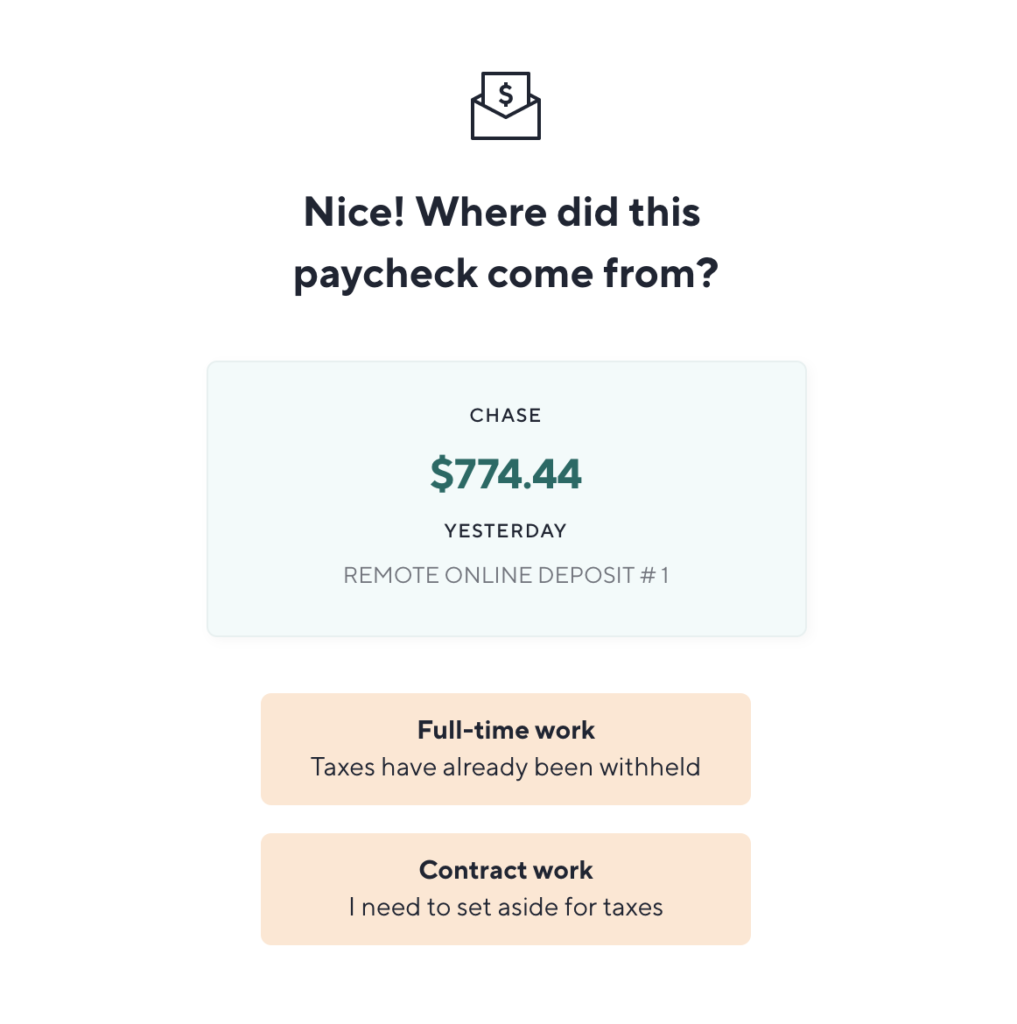

Now, I tell Catch.Co that it was a paycheck, it guides me to their website or their app, and I login. It prompts me and asks me to give a little more info about the money I received.

I let them know it was for contract work, that I will need taxes withheld. I could also choose full time work and it would only take out vacation time.

I click move 286.55 to Catch and it will then transfer that money from my bank account to a separate Catch.Co account that I can access through their website. The money is basically in a bank account and can be accessed any time, my plan as of yet is to pay my taxes, then give myself a refund for the additional money that is withheld.

From my research with how I have it setup, it looks like the risk is pretty low. The withholding account and the vacation time are both held in FDIC insured accounts, so it’s no different than any other bank. They do also have retirement options where they collect a small management fee and it seems like that is how they make their money. There is no monthly fee to use it how I’ve displayed here. While I recommend doing your own research, I have to say I’ve been happy using the service for about 3 months now.

It’s always been a headache trying to keep track of my 1099 income and doing my taxes at the end of the year was always a little nerve racking, I think that Catch.co takes the guess work out of it, simplifying the process. Check it out!

Bolt Lighting Rental Inc is a lighting rental house located in the San Francisco Bay Area. We’re committed to training the next generation of technicians everywhere. Check out our instagram for daily educational content.